Thermal Jumpers Market Size Worth USD 20,12,537.70 Thousand by 2034 Driven by EV Adoption and Electronics Miniaturization

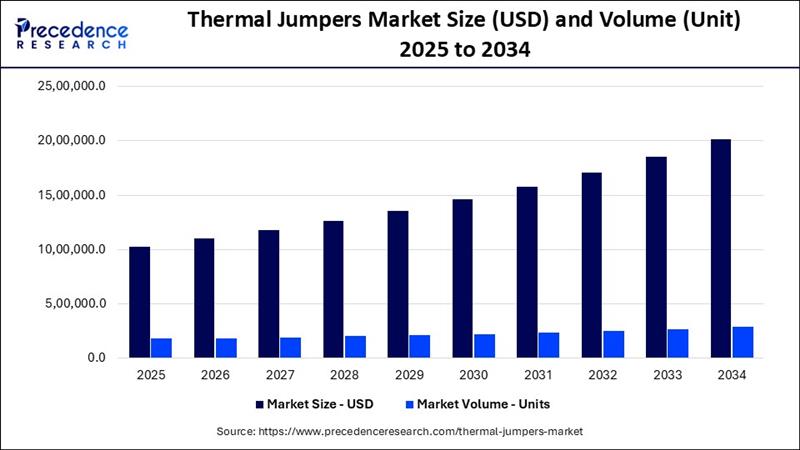

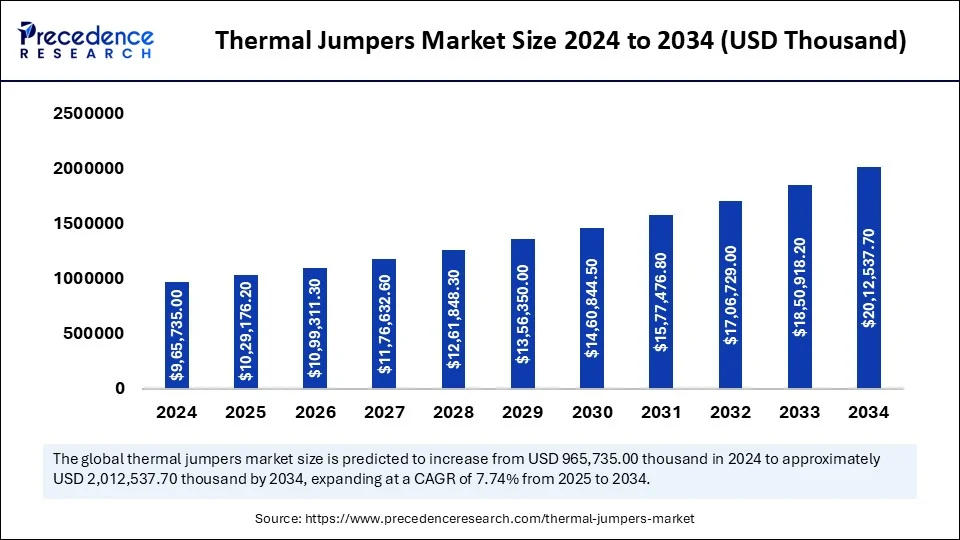

According to Precedence Research, the global thermal jumpers market size will grow from USD 10,29,176.20 thousand in 2025 to nearly USD 20,12,537.70 thousand by 2034, with an expected CAGR of 7.74 % from 2025 to 2034.

Ottawa, Sept. 08, 2025 (GLOBE NEWSWIRE) -- In terms of market size, the global thermal jumpers market size was valued at USD 9,65,735.00 thousand in 2024 and is estimated to rise from USD 10,29,176.20 thousand in 2025 to over USD 20,12,537.70 thousand by 2034. The market is growing at a CAGR of 7.74% from 2025 to 2034. The growing awareness of thermal protection in electric vehicles and the popularity of outdoor sports drive the market growth.

In terms of volume, the global thermal jumpers market volume accounted for 1,79,132.70 units in 2025 and is predicted to grow from 1,85,391.00 units in 2026 to nearly 2,90,089.90 units by 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/5877

Thermal Jumpers Market Key Insights:

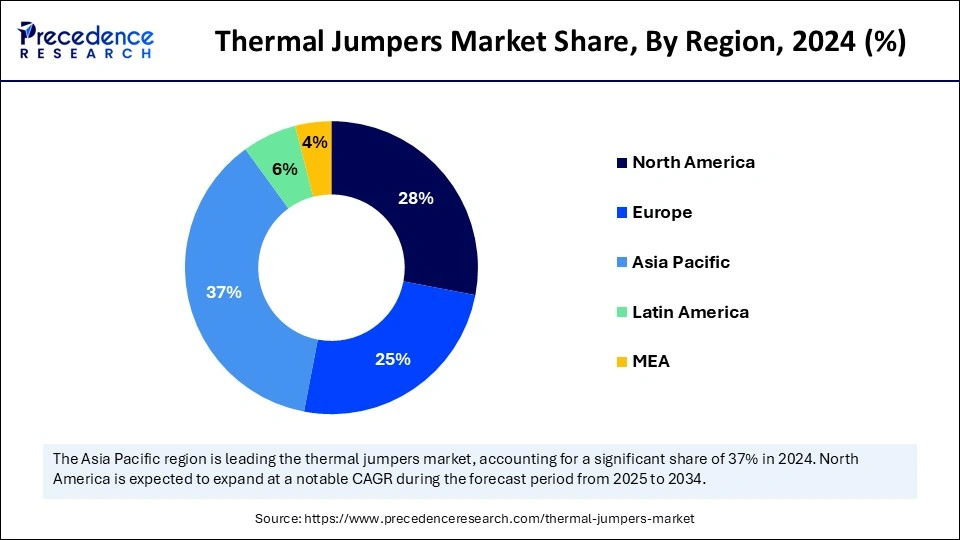

- Asia Pacific accounted for the largest market share of 37% in 2024.

- North America is poised to grow at a notable CAGR of 7.65% from 2025 to 2034.

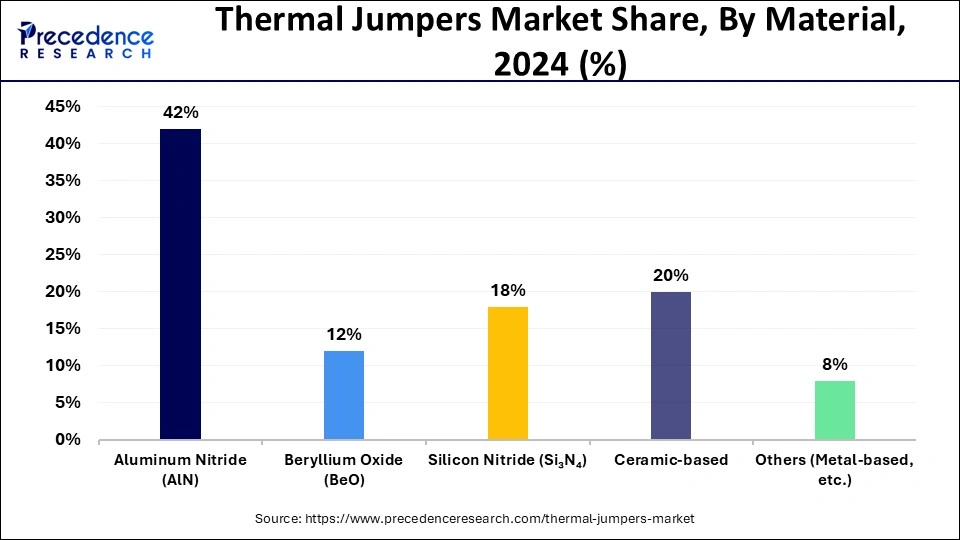

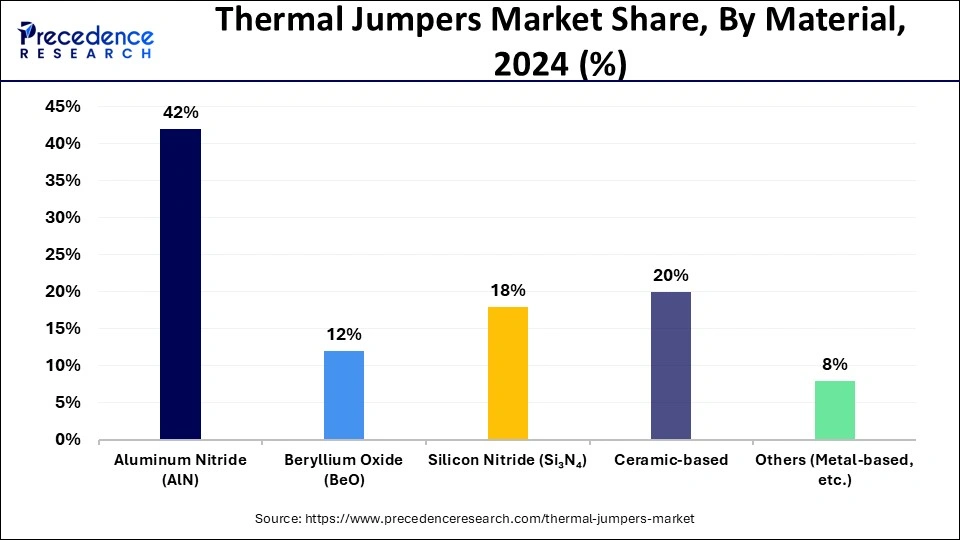

- By material, the aluminum nitride (AlN) segment contributed the highest market share of 42% in 2024.

- By material, the silicon nitride (Si₃N₄) segmentis growing at a solid CAGR of 9.04% between 2025 and 2034.

- By mounting style, the surface-mount thermal jumpers (SMD) segment held the major market share of 56% in 2024.

- By mounting style, the embedded thermal jumpers segment is expected to grow at a notable CAGR of 8.55% from 2025 to 2034.

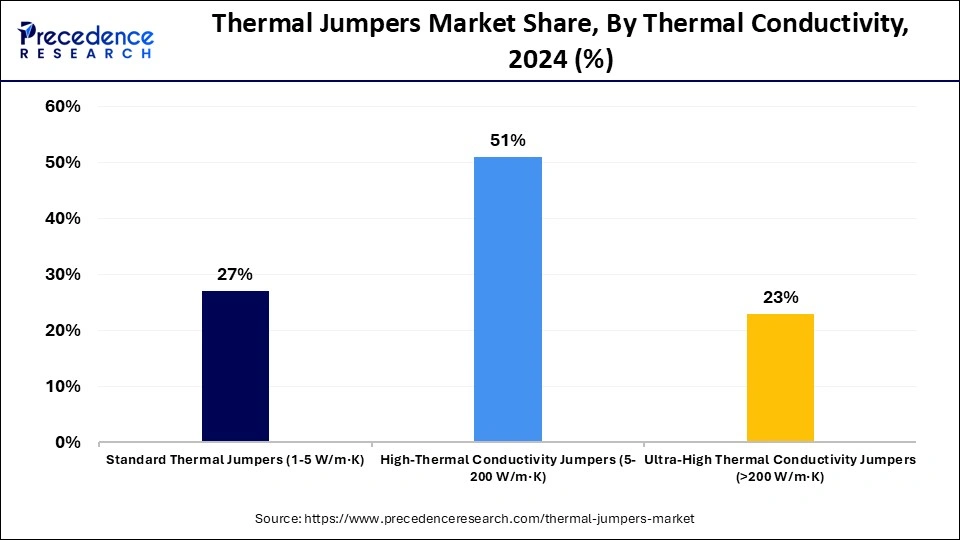

- By thermal conductivity, the high-thermal conductivity jumpers segment captured the highest market share of 51% in 2024.

- By thermal conductivity, the ultra-high thermal conductivity jumpers (>200 W/m·K) segment is expanding at a solid CAGR of 8.55% between 2025 and 2034

- By application, the power electronics segment generated the largest market share of 38.18% in 2024.

- By application, the automotive electronics segment is poised to expand at a CAGR of 9.11% in the forecast period.

Thermal Jumpers Market Size (USD Thousand) Analysis

Thermal Jumpers Market Size by Material (USD Thousand) 2021 to 2024

| By Material - US$ Thousand | 2021 | 2022 | 2023 | 2024 |

| Aluminum Nitride (AlN) | 2,80,562.0 | 3,05,713.6 | 3,30,105.5 | 3,57,185.2 |

| Beryllium Oxide (BeO) | 87,511.2 | 93,926.6 | 99,888.0 | 1,06,643.9 |

| Silicon Nitride (Si₃N₄) | 1,48,504.3 | 1,62,986.7 | 1,77,228.9 | 1,93,564.8 |

| Ceramic-based | 1,64,415.8 | 1,76,214.4 | 1,87,131.5 | 1,99,564.0 |

| Others (Metal-based, etc.) | 89,726.5 | 96,163.0 | 1,02,100.9 | 1,08,777.1 |

| Total | 7,70,719.9 | 8,35,004.4 | 8,96,454.9 | 9,65,735.0 |

Thermal Jumpers Market Size by Thermal Conductivity (USD Thousand) 2021 to 2024

| By Thermal Conductivity - US$ Thousand | 2021 | 2022 | 2023 | 2024 |

| Standard Thermal Jumpers (1-5 W/m·K) | 3,02,976.2 | 3,23,179.6 | 3,41,375.3 | 3,61,216.6 |

| High-Thermal Conductivity Jumpers (5-200 W/m·K) | 3,50,832.1 | 3,83,156.8 | 4,14,732.1 | 4,50,520.3 |

| Ultra-High Thermal Conductivity Jumpers (>200 W/m·K) | 1,16,911.6 | 1,28,668.0 | 1,40,347.5 | 1,53,998.1 |

| Total | 7,70,719.9 | 8,35,004.4 | 8,96,454.9 | 9,65,735.0 |

Thermal Jumpers Market Size by Thermal Conductivity (USD Thousand) 2021 to 2024

| By Mounting Style - US$ Thousand | 2021 | 2022 | 2023 | 2024 |

| Surface-Mount Thermal Jumpers (SMD) | 4,37,184.4 | 4,75,274.6 | 5,11,958.0 | 5,53,141.2 |

| Through-Hole Thermal Jumpers | 2,20,351.6 | 2,36,036.0 | 2,50,556.9 | 2,66,923.1 |

| Embedded Thermal Jumpers | 1,13,183.9 | 1,23,693.8 | 1,33,940.0 | 1,45,670.7 |

| Total | 7,70,719.9 | 8,35,004.4 | 8,96,454.9 | 9,65,735.0 |

Thermal Jumpers Market Size by Application (USD Thousand) 2021 to 2024

| By Application - US$ Thousand | 2021 | 2022 | 2023 | 2024 |

| Power Electronics | 2,69,301.1 | 2,93,396.7 | 3,16,643.7 | 3,42,711.8 |

| LED Lighting Systems | 1,00,875.3 | 1,07,675.6 | 1,13,846.9 | 1,20,793.2 |

| RF & Microwave Components | 80,086.9 | 87,029.4 | 93,697.7 | 1,01,226.1 |

| Automotive Electronics | 1,54,444.2 | 1,69,359.6 | 1,84,079.6 | 2,00,792.9 |

| 5G & Telecom Infrastructure | 1,11,613.6 | 1,20,123.1 | 1,28,120.1 | 1,37,130.0 |

| Others (Medical Devices, etc.) | 54,398.8 | 57,420.0 | 60,066.8 | 63,081.0 |

| Total | 7,70,719.9 | 8,35,004.4 | 8,96,454.9 | 9,65,735.0 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5877

Thermal Jumpers Market Overview

A thermal jumper is an electrical component made up of electrical insulating materials. Thermal jumper offers high thermal conductivity and electrical isolation. A thermal jumper provides benefits like circuit integrity, extension of component life, and higher power handling. They transfer heat from the hot component to the heat sink. Thermal jumpers are widely used in applications like RF amplifiers, data servers, power supplies, diodes, converters, and laser diodes.

Emerging Trends in the Thermal Jumpers Market

-

Smart Thermal Management Solutions: Thermal jumpers are evolving into intelligent components, incorporating embedded sensors and smart materials that dynamically adjust heat flow in response to operating conditions.

-

Advanced Materials & Architectures: Innovations such as phase change materials (PCMs), nanocomposites, and ceramic-enhanced polymers are being adopted to improve thermal conductivity, reduce weight, and enhance survival under extreme thermal stress.

-

Lightweight & Compact Designs: There's increasing demand for ultra-compact and low-mass thermal jumpers tailored for high-density electronics, enabling effective heat dissipation without adding bulk.

- Custom-Tailored Solutions for Specific Use Cases: Thermal jumpers are increasingly being engineered with bespoke form factors and performance profiles, optimized for sectors like aerospace, electric vehicles, or advanced semiconductor devices.

Browse Full Study: Thermal Jumpers Market Size, Share & Forecast (2025–2034) →

https://www.precedenceresearch.com/thermal-jumpers-market

Thermal Jumpers Market Opportunity

Growing Electronic Industry Surges Demand for Thermal Jumpers

The growing electronic industry and increasing adoption of electronic devices like laptops, smartphones, computers, and wearables increase demand for thermal jumpers. The increasing miniaturization of electronic devices increases the adoption of thermal jumpers for effective thermal management. The development of high-power electronics components increases the adoption of thermal jumpers.

The growing expansion of 5G infrastructure and integration of artificial intelligence with electronics increases the adoption of thermal jumpers. The growing development of advanced power modules, CPUs, and graphic processing unit (GPUs) for electronics increases the adoption of thermal jumpers. The increasing modernization of electronics and the complexity of electronics increase demand for thermal jumpers. The growing electronic industry creates an opportunity for the growth of the thermal jumpers market.

Limitations and Challenges in the Thermal Jumpers Market

What is the Limitation for the Thermal Jumpers Market?

High Manufacturing Cost Limits the Expansion of the Market

Despite several benefits of the thermal jumpers, the high manufacturing cost restricts the market growth. Factors like the need for premium materials, complex manufacturing processes, specialized machinery, advanced fibers, and stringent quality control are responsible for high manufacturing costs. The need for premium materials like specialized synthetic blends and merino wool increases the costs.

The utilization of advanced synthetic fibers like spandex, polyester, and nylon increases the cost. The advanced techniques, like the development of a protective layer and specialized coatings, increase the cost. The need for specialized machinery and the requirement of a skilled workforce increase the cost. The high manufacturing cost hampers the growth of the thermal jumpers market.

Thermal Jumpers Market Report Scope

| Report Attributes | Details | |

| Market Size in 2024 | USD 9,65,735.00 Thousand | |

| Market Size in 2025 | USD 10,29,176.20 Thousand | |

| Market Size by 2034 | USD 20,12,537.70 Thousand | |

| CAGR (2025 to 2034) | 7.74% | |

| Dominating Region in 2024 | Asia Pacific | |

| Fastest Growing Region (2025 to 2034) | North America | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | Material Type, Mounting Style, Thermal Conductivity, Application and Regions | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Thermal Jumpers Market Regional Outlook

How Big is the Asia Pacific Thermal Jumpers Market?

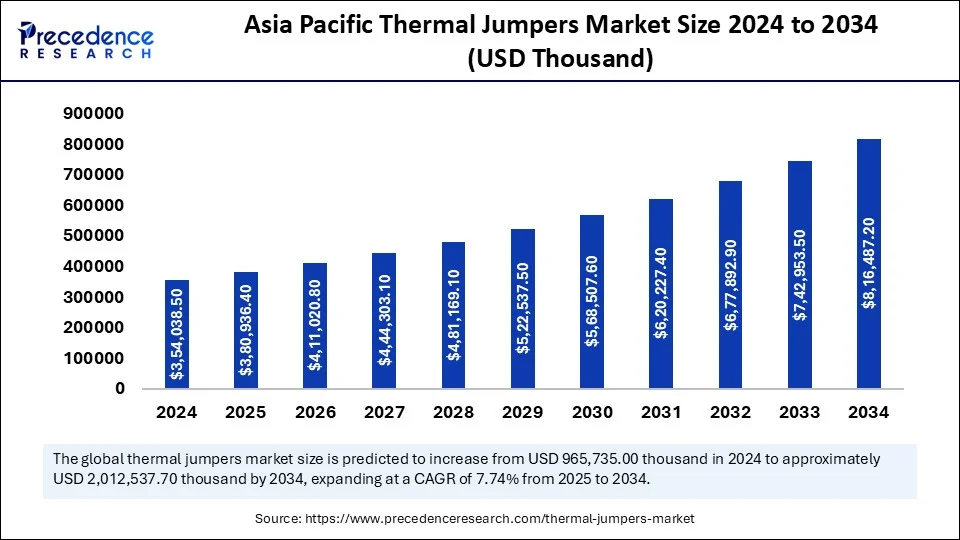

Asia Pacific thermal jumpers market size reached USD 3,80,936.4 thousand in 2025 and is projected to reach around USD 8,16,487.20 thousand by 2034, growing at a CAGR of 8.84% from 2025 to 2034.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/5877

How Asia Pacific Dominated the Thermal Jumpers Market?

Asia Pacific dominated the thermal jumpers market in 2024. The growing fashion trends and growth in textile heritage increase demand for thermal jumpers. The increasing demand for comfort products and high spending on fashionable winter wear increases the adoption of thermal jumpers. The rise in online shopping and growing outdoor recreational activities increases demand for thermal jumpers. The growth in winter tourism and the growing demand for stylish winter wear increase the adoption of thermal jumpers, driving the overall growth of the market.

Why is North America Experiencing the Fastest Growth in the Thermal Jumpers Market?

North America is experiencing the fastest growth in the market during the forecast period. The growing outdoor activities like winter trekking, skiing, and snowboarding increase demand for thermal jumpers. The strong preference for winter apparel and the increasing need for athletic wear increase demand for thermal jumpers. The ongoing technological advancements in thermal jumpers and the availability of a wide products support the overall growth of the market.

Thermal Jumpers Market Segmentation Insights

Material Type Insights

Why did the Aluminum Nitride Segment Dominate the Thermal Jumpers Market?

The aluminum nitride (AIN) segment dominated the thermal jumpers market in 2024. The growing demand for various electronic devices like wearables, smartphones, and tablets increases the adoption of aluminum nitride. AIN offers high thermal conductivity and excellent electrical insulation.

The rise in electric vehicles and the growing miniaturization of electronic devices increase demand for AIN. The expansion of 5G networks and strong support for wireless communication increase demand for AIN. The growing demand for AIN across industries like power electronics, aerospace, and defense drives the overall growth of the market.

The silicon nitride segment is the fastest-growing in the market during the forecast period. The growing development of automotive components like brake parts, turbocharger rotors, and exhaust manifolds increases demand for silicon nitride. The focus on enhancing the safety of aircraft and the growing miniaturization of electronic devices increase the adoption of silicon nitride. The increasing production of hybrid and electric vehicles increases demand for silicon nitride for the development of various automotive components, supporting the overall growth of the market.

Mounting Style Insights

How the Surface-Mount Thermal Jumpers Segment Held the Largest Share in the Thermal Jumpers Market?

The surface-mount thermal jumpers (SMD) segment held the largest revenue share in the thermal jumpers market in 2024. The growing miniaturization of electronic devices and the complexity in electronics increase the demand for SMD. The growing development of automated pick-and-place machines and electrical isolation increases demand for SMD. The development of RF amplifiers, power supplies, and converters increases the adoption of SMD, supporting the overall growth of the market.

The embedded thermal jumpers segment is experiencing the fastest growth in the market during the forecast period. The technological advancements in electronics and the development of connected devices increase demand for embedded thermal jumpers. The complexity in PCB component design and the development of data centers increase the adoption of embedded thermal jumpers. The growing utilization of embedded thermal jumpers in sectors like smart energy grids, automation, and healthcare drives the overall growth of the market.

Thermal Conductivity Insights

Why did the High-Thermal Conductivity Jumpers Segment Dominate the Thermal Jumpers Market?

The high-thermal conductivity jumpers (5-200 W/m.K) segment dominated the thermal jumpers market in 2024. The rise in electric vehicles and the growing adoption of wind & solar energy increase demand for high thermal conductivity jumpers. The growing development of high-power energy storage systems and advanced electronics increases the adoption of high thermal conductivity jumpers. The smart grid technology and growing telecommunications increase demand for high-thermal conductivity jumpers, driving the overall growth of the market.

The ultra-high thermal conductivity (>200 W/m.K) segment is the fastest-growing in the market during the forecast period. The growing development of flexible electronics and the expansion of 5G increase demand for ultra-high thermal conductivity. The ongoing advancements in industries like 5G telecommunications, power electronics, automotive, and aerospace increase demand for ultra-high thermal conductivity, supporting the overall growth of the market.

Application Insights

Which Application Held the Largest Share in the Thermal Jumpers Market?

The power electronics segment held the largest revenue share in the thermal jumpers market in 2024. The strong focus on lowering energy consumption increases demand for power electronics. The growing expansion of renewable energy sources like wind & solar energy increases the adoption of power electronics. The growing adoption of smart grid technologies and industrial automation increases demand for power electronics, driving the overall growth of the market.

The automotive electronics segment is experiencing the fastest growth in the market during the forecast period. The rise in electric vehicles and the increasing development of ADAS increase demand for thermal jumpers. The growing modernization of vehicles increases the adoption of thermal jumpers for the development of autonomous, braking, and steering operations. The stringent emission regulations and strong government regulations increase demand for thermal jumpers for the development of automotive electronics. The growing development of advanced features like infotainment systems, HVAC systems, and personalised comfort features supports the overall growth of the market.

Top Companies in the Thermal Jumpers Market

-

Vishay Intertechnology: Offers a broad range of passive electronic components, including thermal jumpers designed for effective heat dissipation and circuit protection.

-

TT Electronics: Provides custom thermal management solutions, including thermal jumper chips for high-density electronic applications.

-

Electrotechnik: Specializes in passive components like thermal jumpers that enhance thermal conductivity and reliability in power electronics.

-

Lotus Microsystems ApS: Innovates in miniaturized thermal management systems, offering thermal jumper solutions suited for advanced microelectronic integration.

-

Stackpole Electronics, Inc. (SEI): Manufactures precision resistors and thermal jumpers used in automotive, industrial, and high-frequency circuit designs.

-

WDI AG: Offers a portfolio of electronic components, including thermal jumper solutions for critical thermal pathways in compact devices.

-

Delta: Provides thermal jumpers as part of its extensive thermal management systems, ensuring efficient cooling in high-performance electronics.

-

3M:Offers advanced thermal interface materials, including thermal jumpers engineered to provide optimal heat transfer in electronic assemblies.

-

Amphenol Industrial Products Group: Supplies ruggedized interconnect and thermal jumper solutions for harsh industrial environments and power electronics.

-

Charles Industries, LLC: Designs thermal management products, including thermal jumpers for telecom and broadband electronic housings.

-

Akahane Electronics Corporation: Develops custom passive components like thermal jumpers tailored for compact and high-efficiency circuit boards.

-

FINECS CO. LTD.: Manufactures microelectronic components, including thermal jumpers that support miniaturization and efficient heat dissipation.

-

NIDEC COPAL ELECTRONICS: Produces precision electronic components, including thermal jumpers used in temperature-sensitive applications like sensors and controls.

Thermal Jumpers Market Segments Covered in the Report

By Material Type

- Aluminum Nitride (AlN)

- Beryllium Oxide (BeO)

- Silicon Nitride (Si₃N₄)

- Ceramic-based

- Others (Metal-based, etc.)

By Mounting Style

- Surface-Mount Thermal Jumpers (SMD)

- Through-Hole Thermal Jumpers

- Embedded Thermal Jumpers

By Thermal Conductivity

- Standard Thermal Jumpers (1-5 W/m·K)

- High-thermal conductivity Jumpers (5-200 W/m·K)

- Ultra-High Thermal Conductivity Jumpers (>200 W/m·K)

By Application

- Power Electronics

- LED Lighting Systems

- RF & Microwave Components

- Automotive Electronics

- 5G & Telecom Infrastructure

- Others (Medical Devices, etc.)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5877

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ The global thermal camera market size was estimated at USD 5.13 billion in 2024 and is anticipated to reach around USD 12.75 billion by 2034, expanding at a CAGR of 9.53% from 2025 to 2034.

➡️ The global thermal interface materials market size was exhibited at USD 4.14 billion in 2024 and is projected to grow from USD 4.62 billion in 2025 to approximately USD 12.44 billion by 2034, expanding at a CAGR of 11.63% from 2025 to 2034.

➡️ The global thermal management market size is expected to be valued at USD 15.27 billion in 2024 and is anticipated to reach around USD 39.98 billion by 2034, expanding at a CAGR of 10.1% over the forecast period 2024 to 2034.

➡️ The global thermal imaging market size is estimated at USD 7.69 billion in 2024 and is anticipated to reach around USD 16.29 billion by 2034, expanding at a CAGR of 7.80% from 2024 to 2034.

➡️ The global aluminum extrusion market size accounted for USD 88.97 billion in 2024 and is predicted to reach around USD 169.22 billion by 2034, growing at a CAGR of 6.64% from 2025 to 2034.

➡️ The global aluminum die casting market size reached USD 80.96 billion in 2024, estimated at USD 85.49 billion in 2025, and is predicted to be worth around USD 139.61 billion by 2034, expanding at a CAGR of 5.60% from 2025 to 2034.

➡️ The global organic electronics market size accounted for USD 161.16 billion in 2024 and is expected to be worth around USD 1,439.10 billion by 2034, at a CAGR of 25.30% from 2025 to 2034.

➡️ The global printed electronics market size accounted for estimated at USD 16.82 billion in 2024 and is predicted to reach around USD 83.77 billion by 2034, growing at a CAGR of 17.42% from 2025 to 2034.

➡️ The global medical electronics market size was accounted for USD 105.01 billion in 2024 and is anticipated to reach around USD 279.46 billion by 2034, growing at a CAGR of 10.28% from 2025 to 2034.

➡️ The global in-mold electronics market size was estimated at USD 307.23 million in 2024 and is anticipated to reach around USD 4626.69 million by 2034, expanding at a CAGR of 31.15% from 2025 to 2034.

➡️ The global plastics in consumer electronics market size accounted for USD 6.52 billion in 2024 and is expected to exceed around USD 9.48 billion by 2034, growing at a CAGR of 3.81% from 2025 to 2034.

➡️ The global consumer electronics market size accounted for USD 809.30 billion in 2024 and is predicted to reach around USD 1406.47 billion by 2034, growing at a CAGR of 5.68% from 2024 to 2034.

➡️The global 3D printed electronics market size is accounted for USD 10.48 billion in 2024 and is anticipated to reach around USD 43.89 billion by 2034, growing at a CAGR of 15.40% from 2024 to 2034.

➡️ The global automotive aluminum extrusion market size accounted for USD 90.83 billion in 2024 and is expected to be worth around USD 200.30 billion by 2034, at a CAGR of 8.23% from 2024 to 2034.

➡️ The global flexible hybrid electronics market size is estimated at USD 155.96 million in 2024 and is anticipated to reach around USD 471.57 million by 2034, expanding at a CAGR of 11.70% from 2024 to 2034.

➡️ The global aerospace electronics market size accounted for USD 119.44 billion in 2024 and is anticipated to reach around USD 224.20 billion by 2034, expanding at a CAGR of 6.50% between 2024 and 2034.

➡️ The global transparent electronics market size accounted for USD 1.76 billion in 2024 and is expected to be worth around USD 12.35 billion by 2034, at a CAGR of 21.5% from 2024 to 2034.

➡️ The global defense electronics market size accounted for USD 176.81 billion in 2024 and is predicted to increase from USD 185.86 billion in 2025 to approximately USD 290.19 billion by 2034, expanding at a CAGR of 5.08% from 2025 to 2034.

➡️ The global marine electronics market size was estimated at USD 6.80 billion in 2024 and is predicted to increase from USD 7.24 billion in 2025 to approximately USD 12.78 billion by 2034, expanding at a CAGR of 6.51% from 2025 to 2034.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.