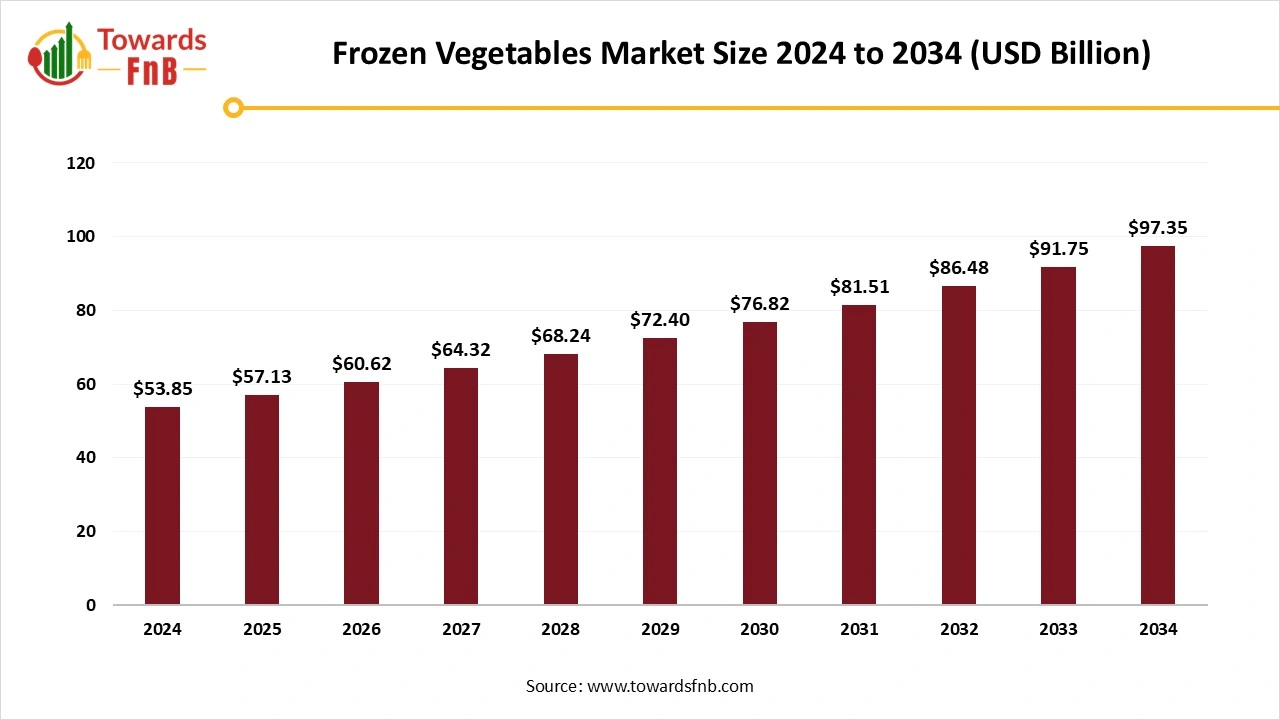

Frozen Vegetables Market Size to Worth USD 97.35 Billion by 2034, Driven by Convenience and IQF Innovations

According to Towards FnB, the global frozen vegetables market size is calculated at USD 57.13 billion in 2025 and is forecasted to reach around USD 97.35 billion by 2034, advancing at a CAGR of 6.1% during the forecast period 2025 to 2034. This steady expansion reflects strong consumer demand for healthier, longer-lasting, and time-saving food alternatives.

Ottawa, Sept. 22, 2025 (GLOBE NEWSWIRE) -- The global frozen vegetables market size stood at USD 53.85 billion in 2024 and is set to increase from USD 57.13 billion in 2025 to around USD 97.35 billion by 2034, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

Hectic lifestyles, high demand for nutritious food options, developing cold chain infrastructure, and emerging economies are some of the major factors for the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5686

Key Highlights of Frozen Vegetables Market

- By region, Europe dominated the frozen vegetables market, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By vegetable type, the single vegetable segment dominated the market with a 35.6% share in 2024, whereas the mixed-vegetables segment is expected to grow in the foreseeable period.

- By freezing technique, the individual quick freezing (IQF) segment held a 55.43% share in 2024, whereas the cryogenic freezing segment is expected to grow in the expected timeframe.

- By end user, the foodservice sector (B2B) dominated the market with a 41.3% share in 2024, whereas the household consumers (B2C) segment is expected to grow in the foreseeable period.

- By distribution channel, the foodservice and B2B channels (serving B2B) segment led the frozen vegetables market with 60.12% share in 2024, whereas the retail channels (serving B2C) segment is expected to grow at the fastest CAGR during the forecast period.

Rising Consumer Demands for Frozen Vegetables in Recent Years

Frozen vegetables are the ones that are washed, cut, blanched, boiled, and frozen immediately. It helps the manufacturers to enhance their shelf life to allow consumers to use them later as well. The procedure also helps to maintain the nutritional levels, taste, and texture of the vegetables as well. Frozen vegetables are highly useful for consumers with hectic schedules and those who are learning the art of cooking. Such vegetables allow consumers to save their time while maintaining their nutritional intake as well. The growth of the market is also observed due to high demand for frozen vegetables by health-conscious consumers who ensure to maintain their nutritional levels.

New Trends in the Frozen Vegetables Market

- High nutritional levels of frozen food and vegetables compared to a few fresh vegetable options help the growth of the frozen vegetables market.

- Cost-effectiveness, enhanced shelf-life, and maintained nutritional and taste value are some of the major factors for the growth of the frozen vegetables market.

- Frozen vegetables meal kits provide convenience to consumers and allow them to save time, further enhancing the growth of the market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/frozen-vegetables-market

Top Products in the Frozen Vegetables Market

| Product Type | Key Features / Attributes | Benefits / Why It’s Popular | Example Applications |

| Frozen Corn | Whole kernels or cob-style, quick-frozen | Sweet flavor, versatile, widely used across cuisines | Soups, salads, stir-fries, side dishes |

| Frozen Peas | Green peas, garden peas, snap peas | High in protein and fiber, easy to cook, kid-friendly | Fried rice, stews, curries, pasta |

| Frozen Broccoli | Cut florets or mixes | Rich in vitamins and antioxidants, it retains nutrition well | Stir-fries, casseroles, steamed vegetable mixes |

| Frozen Green Beans | Cut or whole beans, snap beans | Low calorie, high fiber, retains texture after cooking | Sautés, casseroles, frozen veggie blends |

| Frozen Spinach | Chopped or whole leaf, portioned blocks | Convenient source of iron and folate; easy storage | Smoothies, dips, pasta sauces, curries |

| Frozen Mixed Vegetables | Blend of carrots, peas, beans, corn, etc. | All-in-one convenience, versatile for multiple meals | Fried rice, soups, frozen meal kits |

| Frozen Carrots | Diced, sliced, or crinkle-cut | Naturally sweet, high beta-carotene content | Stews, soups, stir-fries |

| Frozen Cauliflower | Florets or riced cauliflower | Keto and low-carb trend; versatile replacement for grains | Cauliflower rice, pizza crusts, curries |

| Frozen Mushrooms | Sliced, diced, or whole | Savory umami flavor, convenient alternative to fresh | Pizzas, pastas, stir-fries, and sauces |

| Frozen Asparagus, Brussels Sprouts & Other Premium Veggies | Seasonal or niche vegetables frozen for year-round use | Expands availability beyond harvest season | Gourmet side dishes, specialty cuisines |

| Frozen Onion & Pepper Mixes | Pre-chopped blends of onions, bell peppers | Time-saving, versatile flavor base | Fajitas, stir-fries, and ready-to-cook meal bases |

Impact of AI in the Frozen Vegetables Market

Artificial intelligence (AI) is transforming the frozen vegetables market by improving quality, efficiency, and responsiveness to consumer demand. In processing facilities, AI-powered computer vision systems are used to sort, grade, and inspect vegetables with high precision, detecting defects, discoloration, or foreign matter faster and more accurately than manual methods. This ensures consistent product quality and compliance with food safety standards. Machine learning models also optimize freezing methods by analyzing temperature, humidity, and storage conditions, helping preserve texture, nutrients, and flavor while reducing energy consumption.

AI-driven demand forecasting predicts consumption trends based on seasonality, health preferences, and regional dietary habits, allowing manufacturers and retailers to better manage inventory and minimize waste. Logistics are further enhanced through AI-powered route optimization, ensuring that frozen vegetables reach stores and consumers while maintaining freshness and efficiency. On the consumer side, AI recommendation engines in e-commerce platforms personalize product suggestions, while sentiment analysis of reviews and social media helps companies adapt product offerings to preferences such as organic, non-GMO, or ready-to-cook options.

Recent Developments in the Frozen Vegetables Market

- In June 2025, Conagra Brands, one of North America’s leading branded food companies, launched 50 new frozen foods in June 2025. The launch line involved single-serve and multi-serve meals, vegetable side dishes, gluten-free, and plant-based meals. (Source- https://www.prnewswire.com)

- In May 2025, OMD Create and Good Food collaborated to introduce Birds Eye Deli’s new premium frozen vegetable range. The main aim of the launch was to provide a premium dining experience to inspire Australians to enhance their midweek meals with the perfect amalgamation of flavors with convenience. (Source- https://www.mi-3.com)

-

In Aug 2025 — Greenyard announced a €50 million investment in a new IQF production line in Belgium, expanding annual capacity by 20% to meet European retail demand.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5686

Frozen Vegetables Market Dynamics

What Are the Growth Drivers of the Frozen Vegetables Market?

Multiple health benefits, intact nutrition, cost-effectiveness, easy preparation, time-saving, and an array of other advantageous points are the major growth drivers of the frozen vegetables market. Such vegetables are highly useful for consumers with a hectic schedule to allow them to cook a nutritious meal in less time. Advancements in freezing technology allow manufacturers to enhance the shelf life of frozen vegetables, and allow consumers to store them for a longer time. Such factors help the frozen vegetables market grow in the foreseeable period.

How Is Improper Supply Chain Management Hampering Growth in the Frozen Vegetables Market?

Issues such as temperature fluctuations, seasonal fluctuations, and logistical problems are some of the major factors obstructing the growth of the frozen vegetables market. Such issues cease the timely delivery of frozen vegetables to the market, further leading to hiked prices of the products available and various other issues faced by the consumer.

How Is a Growing Number of Health-Conscious Consumers Helping the Growth of the Frozen Vegetables Market?

A growing population of consumers with a health-conscious attitude is helping the growth of the frozen vegetables market in the foreseeable future. Such consumers prefer frozen foods and snacks as they help them to maintain their nutritional levels of the body without any compromise in the taste and texture of food options. It is also a cost-effective and time-saving option, further fueling the market’s growth. Collaboration in existing companies and innovation to improve the effectiveness of frozen products are some of the major factors to enhance the growth of the market in the forecast period.

Frozen Vegetables Market Regional Analysis

Europe Led the Frozen Vegetables Market in 2024

Increased imports and import prices are the major factors for the growth of the frozen vegetables market in Europe. The growing population of vegetarians and vegans in the region, leading to high demand for a plant-based diet, is also a major market growth factor. High demand for organic, fresh, and frozen fruits and vegetables, cost-effective and time-saving options, also leads to the growth of the market in the region.

Asia Pacific Is Expected to Grow in the Forecast Period

Asia Pacific is expected to grow in the foreseeable period due to the high demand for frozen vegetables in the region, leading to the growth of the frozen vegetables market. Major Asian countries such as Singapore rely on imports of fruits and vegetables for the growing population. Hence, it has a major role in the growth of the market. Other factors, such as the growing population of vegetarians and vegans, high demand for frozen meal prep kits, and high demand for convenient food and snack options, are also aiding the growth of the market.

Frozen Vegetables Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 6.1% |

| Market Size in 2024 | USD 53.85 Billion |

| Market Size in 2025 | USD 57.13 Billion |

| Market Size by 2034 | USD 97.35 Billion |

| Dominated Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Frozen Vegetables Market Segmental Analysis

Vegetable Types Analysis

The single-vegetable segment led the frozen vegetables market in 2024 due to the multiple benefits of the product category. Fresh and frozen vegetables are easy to use, convenient, and time-saving for consumers with hectic schedules, allowing them to prepare meals in less time and maintain their nutritional levels as well. Vegetables and fruits are essential for overall good health, lowering the chances of cancer, stroke, diabetes, and obesity. Hence, consumers on a weight loss spree also help the growth of the market due to high demand for fresh and frozen fruits and vegetables.

The mixed vegetables segment is expected to grow in the foreseeable period, as the segment highlights the consumption of different types of vegetables along with leafy vegetables. Such green and cruciferous vegetables are high in fiber, minerals, vitamins, antioxidants, and various other essential nutrients. Leafy vegetables are also a good source of beta-carotene, which helps to lower the chances of cancer, further aiding the growth of the frozen vegetables market.

Freezing Technique Analysis

The individual quick freezing (IQF) segment dominated the frozen vegetables market in 2024 and is expected to retain its market position in the foreseeable period as well. The market also observes growth due to high demand for the IQF technique to store cut and diced vegetables, fruits, and seafood to enhance their shelf life. Such options are in high demand for the industrial sector as well, further helpful for the growth of the market.

The cryogenic freezing segment is expected to grow in the forecast period, as the technique highlights the importance of maintaining a constant temperature, further fueling the growth of the frozen vegetables market. It helps to enhance the shelf life of vegetables and fruits, meat, and various other food products. The segment also aids cost-effectiveness, environmental stability, and maintains sustainability as well.

End User Analysis

The foodservice sector (B2B) segment dominated the frozen vegetables market in 2024 due to the reach of a wider range of audience. The segment also highlights the importance of cost-efficiency, lower sales costs, and automation. The segment focuses on expanding its customer base, profit margins, and efficiency, further fueling the growth of the market.

The household consumers (B2C) segment is expected to grow in the foreseeable period because the segment focuses on the profits made by the household segment, which is helpful for the practical growth of the market. High margins, lower waste, and improved efficiency are other factors helping the segment grow, further fueling the growth of the frozen vegetables market.

Distribution Channel Analysis

The foodservice and B2B channels segment dominated the frozen vegetables market in 2024 as the segment helps to reach a wider audience, enhances the sales and visibility of the market, further fueling its growth. Hence, the segment aided in the growth of the market. The segment also enhances the chances of cross-sell opportunities, further fueling the market’s growth.

The retail channels segment is expected to grow in the foreseen period as the segment highlights the importance of enhanced shelf life of food products, cost effectiveness, intact nutritional value of frozen vegetables, and their maintained taste and texture. The segment also enhances the importance of cost-effectiveness and lower wastage, which is helpful for the growth of the frozen vegetables market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- India Flavored Milk Market: The India flavored milk market size is forecasted to expand from USD 345.96 million in 2025 to USD 560.13 million by 2034, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Soybean Seed Market: The global soybean seed market size is projected to expand from USD 11.37 billion in 2025 to USD 21.09 billion by 2034, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

- Wheat Protein Market: The global wheat protein market size is forecasted to reach from USD 7.69 billion in 2025 to USD 11.43 billion by 2034, expanding at a CAGR of 4.5% during the forecast period from 2025 to 2034.

- Gummy Supplements Market: The global gummy supplements market size is expected to grow from USD 7.29 billion in 2025 to USD 13.63 billion by 2034, at a CAGR of 7.2% over the forecast period from 2025 to 2034.

- Pulse Ingredients Market: The global pulse ingredients market size is forecasted to expand from USD 23.24 billion in 2025 to USD 30.86 billion by 2034, growing at a CAGR of 3.2% during the forecast period from 2025 to 2034.

- Essential Oil Market: The global essential oil market size is expected to grow from USD 28.24 billion in 2025 to USD 61.83 billion by 2034, at a CAGR of 9.1% over the forecast period from 2025 to 2034.

- Compound Feed Market: The global compound feed market size is expected to grow from USD 614.57 billion in 2025 to USD 986.58 billion by 2034, at a CAGR of 5.4% over the forecast period from 2025 to 2034.

- Bakery Premixes Market: The global bakery premixes market size is forecasted to expand from USD 456.8 million in 2025 to USD 763.2 million by 2034, growing at a CAGR of 5.96% during the forecast period from 2025 to 2034.

- Sweeteners Market: The global sweeteners market size is forecasted to expand from USD 113.17 billion in 2025 to USD 156.26 billion by 2034, growing at a CAGR of 3.65% during the forecast period from 2025 to 2034.

- Functional Food Ingredients Market: The global functional food ingredients market size is forecasted to expand from USD 127.48 billion in 2025 to USD 232.40 billion by 2034, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

Top Companies in the Frozen Vegetables Market:

- Ardo Group – A leading European supplier of frozen vegetables, herbs, and fruits with a strong global export presence.

- Bonduelle Group – French multinational specializing in canned and frozen vegetables with a focus on healthy and sustainable solutions.

- Birds Eye Foods, Inc. – Iconic U.S. frozen food brand known for peas, corn, and vegetable-based meal solutions.

- McCain Foods Limited – Canadian giant best known for frozen potato products, also active in vegetable-based frozen foods.

- Simplot Company – U.S.-based agribusiness offering frozen potatoes, vegetables, and farm-to-table food solutions.

- Greenyard – Belgium-based company producing frozen, fresh, and prepared vegetable products for retail and foodservice.

- Pinnacle Foods (Birds Eye) – Former U.S. packaged foods company (acquired by Conagra) with Birds Eye as its flagship frozen vegetable brand.

- AGRANA Group – Austrian producer of fruit preparations and frozen fruits/vegetables for industrial and retail applications.

- Iceland Foods Ltd. – UK retailer specializing in frozen foods, including private-label frozen vegetables.

- Crop’s NV – Belgian company producing frozen vegetables, fruits, and ready-to-use vegetable mixes for global markets.

- ConAgra Foods – U.S. food giant with Birds Eye and Healthy Choice brands, offering extensive frozen vegetable lines.

- Lamb Weston – Known for frozen potato products, also offering vegetable blends and side dishes for retail and foodservice.

- Findus Sweden – Leading Scandinavian brand offering frozen vegetables, fish, and ready meals with a strong Nordic market presence.

- Gelagri Bretagne – French cooperative producing frozen vegetables under the Paysan Breton and other brands.

- General Mills Inc. – Global food company with some frozen vegetable offerings under Green Giant.

- Vivartia – Greek food group producing frozen vegetables and ready meals for Mediterranean cuisine markets.

-

Pictsweet Farms – U.S. family-owned business focused on frozen vegetables and farm-fresh produce for retail.

Segments Covered in the Report

By Vegetable Type

Single Vegetables

- Peas

- Corn

- Green Beans

- Carrots

- Broccoli

- Cauliflower

- Okra

- Zucchini

- Mushrooms

Mixed Vegetables

- Stir-Fry Mix

- Soup Mix

- Asian Vegetable Mix

- Mediterranean Mix

- Corn-Carrot-Peas Blend

- Custom Vegetable Blends

Leafy Greens

- Spinach

- Kale

- Mustard Greens

- Collard Greens

- Swiss Chard

Root Vegetables

- Potatoes

- Carrots

- Beets

- Turnips

- Parsnips

Legumes

- Green Peas

- Edamame (young soybeans)

- Lima Beans

- Chickpeas

- Lentils

Others

- Artichokes

- Asparagus

- Bell Peppers

- Brussels Sprouts

- Leeks

- Onions

By Freezing Technique

- Individual Quick Freezing (IQF)

- Blast Freezing

- Belt/Tunnel Freezing

- Cryogenic Freezing

By End User

- Household Consumers (B2C)

- Foodservice Sector (B2B)

- Restaurants

- Hotels

- Cafés

- Catering Services

- Food Processing Sector

By Distribution Channel

- Retail Channels (serving B2C)

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Foodservice & B2B Channels (serving B2B)

- Foodservice Distributors

- B2B/Wholesale Distributors

- Institutional Supply (schools, hospitals, defence)

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5686

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Confectionery Ingredients Market: https://www.towardsfnb.com/insights/confectionery-ingredients-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Poultry Feed Market: https://www.towardsfnb.com/insights/poultry-feed-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Plant-Based Protein Market: https://www.towardsfnb.com/insights/plant-based-protein-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Baking Ingredients Market: https://www.towardsfnb.com/insights/baking-ingredients-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Dairy Processing Equipment Market: https://www.towardsfnb.com/insights/dairy-processing-equipment-market

➡️Meat Products Market: https://www.towardsfnb.com/insights/meat-products-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Seed Coating Materials Market: https://www.towardsfnb.com/insights/seed-coating-materials-market

➡️Precision Fermentation Market: https://www.towardsfnb.com/insights/precision-fermentation-market

➡️Pet Dietary Supplements Market: https://www.towardsfnb.com/insights/pet-dietary-supplements-market

➡️Organic Food Market: https://www.towardsfnb.com/insights/organic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.